When EG purchased 95 North Quay in Brisbane in 2018, the building’s 2 star NABERS Energy rating was central to its appeal.

According to the Green Building Council of Australia’s Opportunity Knocks report, up to 80,000 ‘mid-tier’ buildings are in need of energy efficiency upgrades.

‘Mid-tier’ refers to buildings that are neither A nor Premium grade but still of reasonable quality. These buildings account for around 80% of Australia’s office stock and half of its floor space.

Constructed between the 1960s and 2000 – at a time before net zero targets shaped corporate strategy or sustainability attracted top talent – these office buildings typically feature technology that is inefficient and energy-hungry.

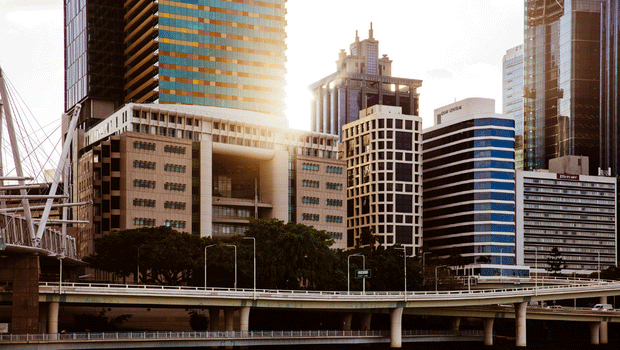

95 North Quay in Brisbane was one of those buildings. Perched on the edge of the Brisbane River in the heart of the city’s legal district, the building had good bones and a beautiful outlook.

But the ‘90s-era building was also ripe for retrofit and its NABERS Energy rating of 2 stars was evidence of plenty of room for improvement.

View the case study here: 95 North Quay, Brisbane QLD

Optimisation and optimism

Established in 2000, EG invests in real estate on behalf of institutional investors and private wealth clients to achieve outstanding returns and lasting positive impact. In 2016, EG launched its first impact investment fund, the High Income Sustainable Office Trust, or HISOT.

EG’s aim was to acquire NABERS Energy underperforming assets and improve them to at least 4.5 stars, while still delivering above market returns. This inverts the current focus of institutional capital which has, in pursuit of 2050 net zero targets, typically focused on new build or premium assets and overlooked existing assets.

“When we undertake capital raising, we meet a lot of investors with very good intentions,” says Linh Pham, EG Delta’s Fund Manager. “Everyone wants to invest in energy efficient buildings. But that usually means Premium-grade new buildings. Smaller, older buildings are often overlooked.

“But we’ve proven that it is easier and cheaper to upgrade older buildings than people think.”

Supported by investors including the Clean Energy Finance Corporation (CEFC), Uniting Financial Services and Deakin University, EG purchased 95 North Quay in Brisbane for $46.2 million in August 2018.

One of EG’s investing pillars is environmental optimisation, which seeks to improve the environmental performance of assets, enhance their investment value, attract great tenants and mitigate the transitional and physical risks of climate change.

At the time of 95 North Quay’s acquisition, CEFC’s Rory Lonergan hoped it would “showcase how existing buildings can become better performers through upgrades that improve their energy efficiency, which extends their working lives”.

Fast facts

- 95 North Quay is a 17-storey commercial office tower owned by the EG Delta Fund

- EG purchased the building in August 2018 for $46.2 million. At the time, it held a NABERS Rating of 2 stars. EG’s plan was to improve the NABERS rating to 4.5 stars or greater

- 8,417 sqm Net lettable area

- 3 levels of basement car parking

- 180-degree views over the Brisbane River, Mount Coot-tha and South Bank

Upgrade to uplift

With the deal inked, EG’s team immediately established a plan to improve the NABERS rating to 4.5 stars or greater.

So how do you bolster the energy efficiency of a B-Grade asset? The journey starts with detailed due diligence to plan the NABERS uplift pathway, which EG’s Divisional Director - Asset Management, Gemma Moulang, calls a “comprehensive list of options for the asset”.

“We sit down as a business and work out what we can do that will upgrade the building, meet our financial obligations and deliver the best return. It’s a fine balance,” Gemma says.

“Slow and steady” is the name of the game, adds EG’s Head of ESG, Ian Lieblich. “It is not always capital intensive to upgrade a building to achieve a 4.5 star NABERS Energy rating. Most buildings have the system to operate at that level. Instead, it’s about interventions at the margins.”

At 95 North Quay, the air conditioning system was at the end of its life and needed to be replaced. “Rather than replace like-for-like, we invested in a system that cost a little bit more but is much more energy efficient. The savings in the long run don’t detract from the financial returns,” Ian says.

We find tenants are increasingly attracted to energy efficient buildings and are willing to pay a premium for a high NABERS rating. And our investors tell us they want to move towards sustainability at a faster pace.

Alongside the upgrade to mechanical systems, many small steps – like tweaks to the building management system, recalibration of chiller set points and replacement of inefficient lighting – add up to a big leap forward in energy efficiency.

EG uses Buildings Alive to track the energy performance of buildings in real time. “One of our biggest lessons at an asset management level is that we need an extraordinarily committed facilities management team – which we are lucky to have,” Gemma notes.

Leading that facilities management team is Karl Morris, CBRE’s Associate Director. He agrees that a series of small interventions are the success secret. “This may mean considering the timing of the cleaning schedule, engaging with tenants so problems are addressed straight away, or keeping a close eye on data to spot spikes in energy use,” he says.

“If you can’t measure it, you can’t save it. We are looking for ways to save energy every day.”

Real zero for real assets

EG’s achievements at 95 North Quay demonstrate the inherent value in revitalising older building stock. But 95 North Quay is just one chapter in EG’s sustainability story.

The EG Delta Fund currently has four buildings in its portfolio, one which is in the process of being elevated from a 1 star NABERS Energy rating to an impressive 5.5 stars.

Ian says EG’s team is now setting their sights on even loftier goals.

“We are in the process of setting a climate target of real zero by 2030, exploring a new, more accurate and ambitious approach to carbon accounting which assesses the portfolio’s carbon footprint every 15 minutes rather than on an annual basis.”

EG’s granular approach to carbon accounting within the built environment creates carbon reduction opportunities focused on demand management and load shifting – two areas which are typically overlooked. “This makes carbon offsets and the associated additionality, integrity and volume concerns a target of the past,” says Ian.

“EG’s commitment to achieve a ‘better path to better returns’ represents our responsibility to deliver intergenerational equity,” says Ian. “We want to leave these buildings in a better state than when we purchased them.”

View the case study here: 95 North Quay, Brisbane QLD

EG’s Delta Fund was established to improve buildings’ ESG performance and NABERS ratings, leveraging the fact that 80% of buildings that will be in use by 2050 already exist. We buy buildings where ESG has historically been ignored – and where NABERS ratings are underperforming – and we invest in environmental and social programs, improving these assets that will be a part of our net zero cities in 2050.