Great environmental outcomes are forged through a combination of commitment and action. The NABERS Sustainable Portfolios Index 2020 (SPI) is available from 7 May 2020, providing a one-stop-shop for the environmental performance of portfolios and funds across Australia. The NABERS SPI celebrates the top 40 property portfolios achieving measurable sustainability actions.

We’re not short of places to look when it comes to finding commitment to sustainability goals in the built environment. Environmental, social, and governance (ESG) criteria continue to gain traction as a way for investors to evaluate companies’ commitments to sustainability outcomes. But when it comes to quantifying the actual action taken to meeting those sustainability commitments, there are only a few trusted sources.

NABERS ratings are a verified and trusted way to quantify delivery against sustainability commitments. In short, you can look to NABERS ratings to see the progress organisations are making towards meeting their sustainability goals.

The NABERS Sustainable Portfolios Index 2020 complements other popular ESG indicators (like GRESB) for investment decisions in Australia and overseas. It showcases portfolios that are committed to improving their sustainability performance and are leading the world in making their progress open and transparent. The NABERS SPI showcases the top 40 performing property portfolios across Australia according to their NABERS ratings and percentage of portfolio rated. It provides comparative business intelligence on where property portfolios stand against their peers. This year the Index covers office buildings and shopping centres.

We are incredibly excited to release the NABERS Sustainable Portfolios Index 2020. This year we saw an enthusiastic 48% increase in participation, with a record 40 portfolios disclosing their energy and water performance. We also launched new categories, to recognise 11 pioneer portfolios who are leading the way on indoor environment quality and waste. – Carlos Flores, Director, NABERS

NABERS, which stands for the National Australian Built Environment Rating System, is a key source of information for investors and major players mobilising capital investment in low-carbon assets and technology, such as the Clean Energy Finance Corporation (CEFC). NABERS ratings are used to measure a building’s energy efficiency, carbon emissions, water consumed, waste produced and indoor environment quality and compare it to similar buildings.

NABERS ratings are different to other schemes because they measure actual environmental impact, not design intent or management strategies. By relying solely on measured results, there are no prescriptive methods to improve ratings and no “picking winners” – only initiatives that actually reduce the environmental impacts of a building will lead to a better rating result.

That’s why the NABERS SPI is so powerful. It shows investors and anyone with an interest in building sustainability a whole portfolio view of actual progress towards reducing emissions, water usage, waste and improving indoor environment quality. This year’s release has a portfolio view which allows investors to see results per portfolio over time. Building owners benefit from being a part of the NABERS SPI by being able to communicate real progress over time and against peers to potential investors.

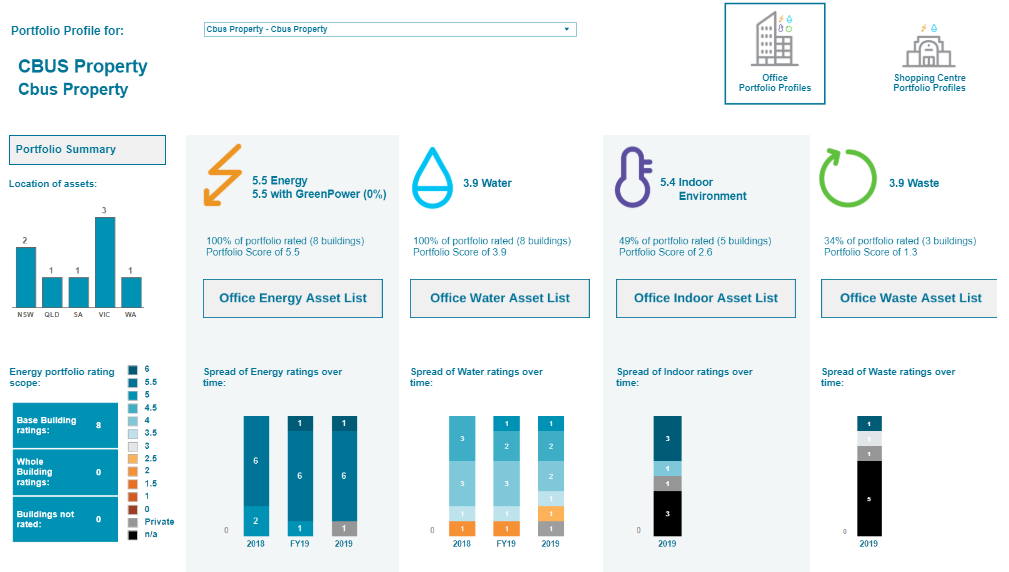

Above: Cbus Property's portfolio results listed on the NABERS Sustainable Portfolios Index 2020

Investors recognise that mitigated climate-related risks improve investment practices and reduces systemic future risks to investments in companies, industries, property, and infrastructure assets. (Investor Group on Climate Change 2019). *

NABERS ratings also have a proven relationship with more financially resilient portfolios. Anthony De Francesco, Managing Director of Real Investment Analytics (RIA), an independent data analytical consulting firm, explains: “There appears to be a strong positive relationship between a high NABERS rating and enhanced investment performance for office property assets: generally reflected in improved property values, lower vacancies, firmer capitalisation rates, and longer weighted average lease expiry (WALE)”.

“NABERS ratings provide an additional metric in evaluating performance of existing property investments but can also be used to identify opportunities for portfolio growth by targeting office buildings with a lower NABERS rating,” says De Francesco.

Key sustainability finance players also see the NABERS SPI as being valuable in driving a more sustainable built environment. “NABERS ratings are a valuable way for the property sector to demonstrate best-in-class performance around energy efficiency, providing a clear pathway to a low emissions property portfolio. We see the NABERS Sustainable Portfolios Index as an important tool for investors in the property sector who are increasingly focused on supporting a more sustainable built environment,” says Sebastian Loewensteijn, the Associate Director at The Clean Energy Finance Corporation.

This year NABERS has partnered with the Net Zero Momentum Tracker, an initiative of ClimateWorks Australia and Monash Sustainable Development Institute, to show companies commitments to Net Zero, closing the distance between intention and action.

NABERS ratings are customised to Australia, independently governed and externally validated – making any NABERS ratings a trusted indicator to well-managed Australian property investments. With the NABERS Sustainable Portfolios Index, fund managers and investors can see sustainable property investment options at a glance.

NABERS ratings give a building a rating from one to six stars - 1 star being “Poor” and 6 stars being “Market Leading”.

Above: NABERS 6-Star rating scale

Each portfolio participating in this year’s Index is leading the world in disclosing their environmental performance openly and transparently. They embody the leadership needed to get to net zero emissions: they disclose their environmental footprint, set ambitious improvement targets and work hard to achieve them. – Carlos Flores, Director, NABERS

NABERS is proud to share these incredible sustainability results and showcase the achievements of these portfolios.

Check out the NABERS Sustainable Portfolios Index 2020.