Available from 19 April 2021, the NABERS Sustainable Portfolios Index 2021 (SPI) is Australia’s first publicly available index showcasing the proven environmental performance of the top 43 building portfolios and funds across the country.

Investors in the property sector are placing increased importance on mitigation of climate risks in buildings. This has been brought into sharper focus following a year of unprecedented global challenges in 2020 which also affected the commercial property sector.

The NABERS SPI, now in its third edition, is globally unique in that it provides a public, whole portfolio view of actual performance in terms of emissions, water usage, waste and indoor environment quality. It also tracks progress over time.

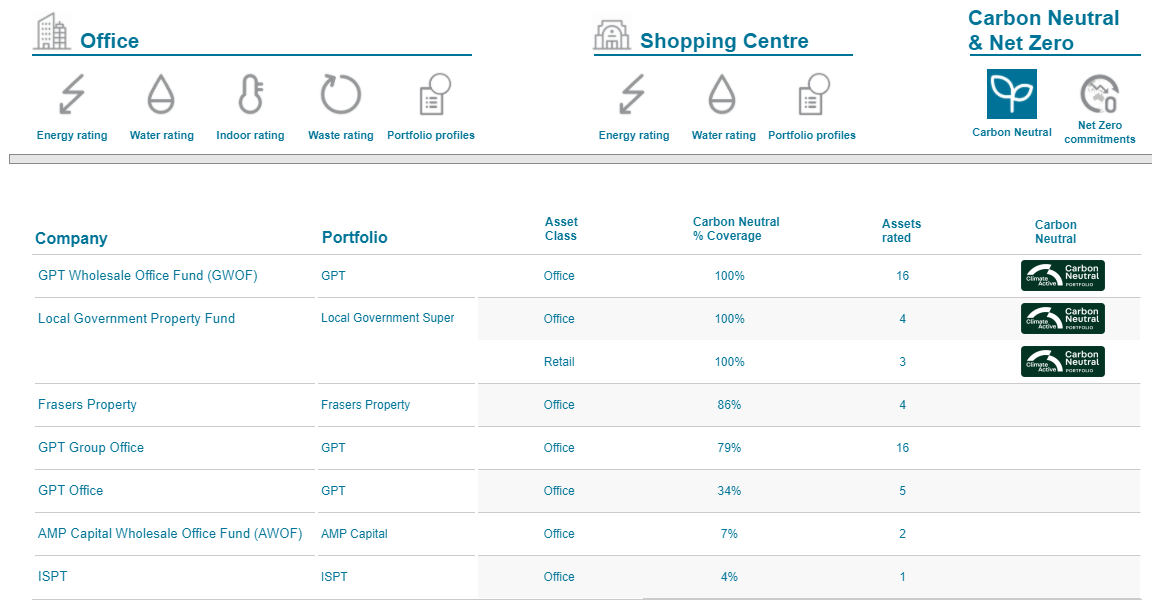

The SPI provides comparative business intelligence on where property portfolios stand against their peers. The Index covers office buildings, shopping centres and this year for the first time showcases building portfolios that have achieved 100% carbon neutrality.

We are incredibly excited to release the NABERS Sustainable Portfolios Index 2021 and are hugely encouraged by the impressive results. Despite the unparalleled challenges of the last year, we’ve seen these organisations double down on their sustainability efforts and continue their many years of hard work to help the environment. We also saw a 13% increase in property portfolios disclosing in the SPI, spearheaded by a 27% increase in funds disclosing their portfolio NABERS Indoor Environment performance. This upward trend despite the circumstances highlights how important sustainability has become for Australian businesses, as well as the central role health and wellbeing will likely play going forward.

- Carlos Flores, Director, NABERS

This year’s Index also showcases two pioneering property portfolios that have achieved full carbon neutrality: Local Government Super’s (LGS) Local Government Property Fund and The GPT Group’s GPT Wholesale Office Fund (GWOF).

“We’re extremely proud our local government property fund is now certified carbon neutral under the Australian Government’s Climate Active Carbon Neutral Standard. We hope this achievement will demonstrate to our members and the wider community that it is possible to effectively reduce emissions and offset our impact on the environment through targeted action,” explains LGS Head of Property, Scott Armstrong.

As the largest carbon neutral portfolio to feature on the Sustainable Portfolios Index 2021, Mark Fookes, Chief Operating Officer, The GPT Group says: “The property sector in Australia has been a global leader in sustainable building design and operations, and moving to carbon neutral well before many other industries will only further demonstrate this leadership position. As an ‘early mover’ in acting on greenhouse gas emissions, GPT has been implementing actions to reduce energy consumption across all of our assets. We are incredibly proud of the ground-breaking work done by our team to achieve 100 per cent carbon neutrality for all operating assets within the GPT Wholesale Office Fund, and we’re pleased to see this celebrated in the NABERS SPI.”

Above: Portfolios reaching Carbon Neutral

Above: Portfolios reaching Carbon Neutral

The SPI 2021 also highlights portfolios that have set public targets to achieve net zero emissions. This year notable schemes include the Net Zero Momentum Tracker, the Green Building Council of Australia (GBCA) and World Green Building Council’s Net Zero Carbon Buildings Commitment, and the Science Based Targets Initiative. These public commitments are bridging the gap between intention and action. Key sustainability finance players also see the NABERS SPI as an important source of information for mobilising capital investment in low-carbon assets and technology. For instance, NABERS portfolio ratings are used as the benchmark for banks providing sustainability linked loans. “It is becoming increasingly important that portfolios demonstrate a commitment to a climate transition in order to access green funding. Portfolios that can demonstrate commitment to emissions reductions, and prove actual emissions reductions will have the upper hand, and NABERS ratings provide a way to prove this for property portfolios.” says Sebastian Loewensteijn, the Associate Director of Sustainability at the Clean Energy Finance Corporation (CEFC).

Key sustainability finance players also see the NABERS SPI as an important source of information for mobilising capital investment in low-carbon assets and technology. For instance, NABERS portfolio ratings are used as the benchmark for banks providing sustainability linked loans. “It is becoming increasingly important that portfolios demonstrate a commitment to a climate transition in order to access green funding. Portfolios that can demonstrate commitment to emissions reductions, and prove actual emissions reductions will have the upper hand, and NABERS ratings provide a way to prove this for property portfolios.” says Sebastian Loewensteijn, the Associate Director of Sustainability at the Clean Energy Finance Corporation (CEFC).

NABERS ratings also have a proven relationship with more financially resilient portfolios. Anthony De Francesco, Managing Director of Real Investment Analytics (RIA), an independent data analytical consulting firm, explains: “There continues to be a strong positive relationship between a high NABERS rating and enhanced investment performance for office property assets. In an ever-changing market, visibility of sustainability credentials and transparent greening of buildings will continue to be regarded as a key investment performance attribute.”

NABERS is proud to share these incredible results, play a role in securing sustainable finance and showcase the achievements of these portfolios.

Check out the NABERS Sustainable Portfolios Index 2021 here.

More about NABERS ratings

NABERS ratings are used to measure a building’s energy efficiency, carbon emissions, water consumed, waste produced and indoor environment quality and compare it to similar buildings.

NABERS ratings give a building a rating from one to six stars - 1 star being “Making a start” and 6 stars being “Market Leading”.

Average star ratings by sector

Above: NABERS 6 star rating scale

When NABERS ratings are first developed three stars is the average rating for the sector. As a market matures the star rating results are not adjusted. This means that buildings can continue to measure their sustainability progress versus the year before. As a result, some of the more mature sectors have a higher average star rating than three.

Average NABERS star ratings by sector

|

|

Energy |

Water |

Waste |

IE |

|

Offices |

4.5 |

3.7 |

2.9 |

4.8 |

|

Shopping Centres |

4.1 |

3 |

|

|

|

Hotels |

4.1 |

3.3 |

|

|

|

Apartment Buildings |

2.9 |

2.8 |

|

|

|

Data Centres |

4.6 |

|

|

|

Above: NABERS average star ratings by sector; Source: Annual report FY20; Only available ratings displayed per sector

NABERS ratings are different from other schemes because they measure actual environmental impact, not design intent or management strategies. By relying solely on measured results, there are no prescriptive methods to improve ratings and no “picking winners” – only initiatives that actually reduce the environmental impacts of a building will lead to a better rating result.

Check out the NABERS Sustainable Portfolios Index 2021.